salt tax deduction limit

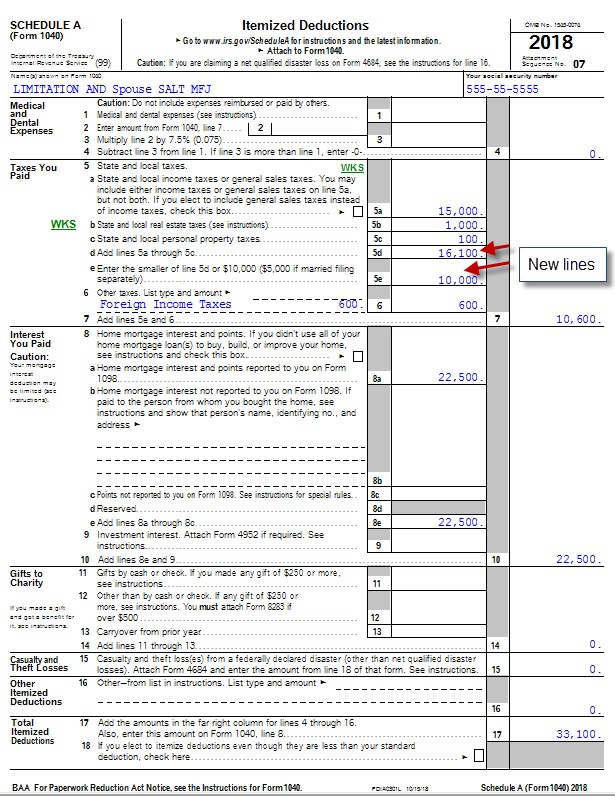

The SALT deduction allows taxpayers who itemize their deductions to reduce their taxable income by the amount of state and local taxes they paid that year up to 10000. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040.

Prospect Of Salt Deduction Increase Gone At Least For A Few Years Route Fifty

Do you operate a pass-through entity PTEWhat is a SALT deductionIRS Notice 2020-75 allowed pass-th.

. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is. The change may be significant for filers who itemize deductions in. Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent.

The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The 10000 limit on SALT.

The new proposal from the Democrats raises. The SALT deduction benefits the high-income earners the most. The 10000 SALT limit may prove burdensome for many taxpayers.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Whats the most effective way to pay your state taxes. Second the 2017 law capped the SALT deduction at 10000 5000 if.

52 rows The state and local tax deduction commonly called the SALT. The SALT deduction limit was part of a larger change to the individual income tax. The first is the new 10000 limitation on deducting state and local taxes also called SALT on your federal income tax return.

The SALT Tax deduction limit or cap was set at 10000 dollars in 2017 but this was set to expire in 2026 and become uncapped. The TCJA lowered tax rates and expanded the standard deduction to 12000 for single filers. As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a.

There is talk that the SALT deduction limit will be. This will leave some high-income. Starting in 2021 through 2030 the SALT deduction limit is increased to 80000.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. This significantly increases the boundary that put a cap on the SALT. But you must itemize in order to deduct state and local taxes on your federal income tax return.

The Tax Cuts and Jobs Act of 2017 placed a 10000 cap on State and Local Tax SALT deductions. New limits for SALT tax write off. IR-2019-59 March 29 2019 The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new limit on the.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. Prior to the change in 2017 about 77 of taxpayers with an adjusted gross income of 100000 or more. If you dont itemize.

The Tax Cuts and Jobs Act. Second is New Jerseys longstanding 10000 cap on deducting. Using Schedule A is commonly referred to as itemizing deductions.

Previously the deduction was unlimited. To be impacted by the limit 3. However for some taxpayers there may be legitimate ways to plan and do the Limbo to come in under the 10000 limit.

2 days agoNow under current law a single filer in Californiawhere the top state tax rate is 133would exceed the SALT deduction cap after earning about 150000 180000 for a.

How Raising The Salt Deduction Limit To 80 000 May Affect Your Taxes

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Tax Reform Affects The State And Local Tax Salt Deduction Tax Pro Center Intuit

State And Local Tax Salt Deduction What It Is How It Works Bankrate

High Income Households Would Benefit Most From Repeal Of The Salt Deduction Cap Detaxify Tax Relief Experts Tax Resolution Irs Debt

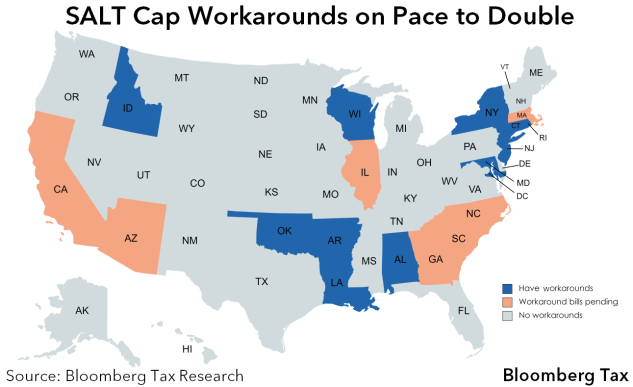

Salt Workarounds Spread To More States As Democrats Seek Repeal

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

How Does The State And Local Tax Deduction Work Ramseysolutions Com

Changes To Federal Salt Deduction Expose Illinois High Taxes

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

Salt Deduction Limit Can You Get Around It American Academy Of Estate Planning Attorneys

Why This Tax Provision Puts Democrats In A Tough Place Time

How Does The Deduction For State And Local Taxes Work Tax Policy Center

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Shaking Up Your Salt Deductions Jmf

Salt Deduction Limit 2022 Bbb Act

Unlock State Local Tax Deductions With A Salt Cap Workaround